FOR the election of the seven nominees named in this proxy statement to serve on our board of directors;

FOR the approval, on an advisory basis, of the compensation of our named executive officers; and

FOR the proposal to ratify the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

With respect to any other proposals to be voted on, they will vote in accordance with the recommendation of our board of directors or, in the absence of such a recommendation, in the discretion of Messrs. Barag, Davis and Rasor. They will not vote your shares of common stock if you do not return the enclosed proxy card or submit your proxy by phone or online. This is why it is important for you to return the proxy card to us (or vote by proxy online or by phone) as soon as possible, whether or not you plan on attending the annual meeting in person.

Q: Who is entitled to vote?

| | | VOTING | | | | | | | ATTENDANCE AND PARTICIPATION: | |

A: | •

Anyone who owned shares of our Class A common stock (“common stock”) at the close of business on April 19, 2016, the record date,7, 2022 is entitled to vote at the annual meeting. |

Q: When is the annual meeting and where will it be held?

•

| |

A: | The annual meeting willEach share is entitled to one vote on each matter to be held on Friday, June 24, 2016, at 10:00 a.m., local time,voted upon at the Westin Atlanta Perimeter North, 7 Concourse Parkway NE, Atlanta, Georgia 30328.annual meeting. |

| | | •

Q: Who can attend the annual meeting?

| | A: | You are entitled to attend the annual meeting only if you are a holder of record or a beneficial owner of shares of our common stock as of the record date or if you hold a valid proxy for the annual meeting. •

To participate in the annual meeting, stockholders of record must enter their 14-digit control number, which can be found on your Notice Regarding the Availability of Proxy Materials or proxy card. •

Stockholders may vote during the annual meeting by following the instructions available on the meeting website. •

If shares are held through an intermediary, such as a bank, broker or other nominee, is the record owner of your shares, you will needstockholders must register in advance to have proof that you are the beneficial owner to be admitted toparticipate in the annual meeting. A recent statement or letter from your bank or broker confirming your ownership as of the record date, or presentation of a valid proxy from a bank, broker or other nominee that is the record owner of your shares, would be acceptableTo register, stockholders must submit proof of your beneficial ownership. You should be preparedtheir proxy power (legal proxy) reflecting their holdings along with their name and email address to present photo identificationComputershare Fund Services. Stockholders may forward an email from their intermediary or attach an image of their legal proxy to shareholdermeetings@computershare.com. Requests for admittance. If you do not provide photo identification or comply with the other procedures outlined above upon request, you may not be admitted to the annual meeting. |

Q: How many shares of common stock can vote?

| | A: | As of the close of business on April 19, 2016, there were 38,772,424 shares of our common stock issued and outstanding. Every stockholder is entitled to one vote for each whole share of common stock held. |

Q: What is a “quorum”?

| | A: | A “quorum”registration must be present in order forreceived no later than 10:00 a.m., Eastern Time, on June 13, 2022. Stockholders will receive an email confirmation from Computershare Fund Services, which will include a control number that will allow the annual meetingstockholder to be a duly held meeting at which business can be conducted. A quorum consists of the presence in person or by proxy of stockholders holding a majority of all the votes entitled to be castattend and vote at the annual meeting. If a broker or other record holder of shares returns a proxy card indicating that it does not have discretionary authority to vote as to a particular matter (“broker non‑votes”), those shares will be treated as not entitled to vote on that matter. Abstentions and broker non-votes will be counted to determine whether a quorum is present. If you submit a properly executed proxy card, even if you “withhold” your vote from one or more director nominees, then you will be considered part of the quorum. | |

Meeting Agenda and Voting Recommendations | | Items of Business | | | Board

Recommendation | | | Page

Number | | | | 1. | | | Election of the six directors named as nominees in the proxy statement | | | | | | FOR | | | 14 | | | | 2. | | | Approval, on an advisory basis, of the compensation of our named executive officers | | | | | | FOR | | | 47 | | | | 3. | | | Ratification of the appointment of our independent auditors | | | | | | FOR | | | 51 | |

In addition to the above matters, we will transact any other business that is properly brought before the annual meeting or any adjournment or postponement thereof. | | A: | Advance Voting Methods You may vote your shares of common stock either in person or by proxy. Whether or not you plan to attend the annual meeting and vote in person or not, we urge you to have your proxy vote recorded in advance of the annual meeting. Stockholders have the following three options for submitting their votes by proxy: (1) online; (2) by phone; or (3) by mail, using the enclosed proxy card (if you received a paper copy of the proxy materials). If you have internet access, we encourage you to vote by proxy online because it is convenient and it saves us significant postage and processing costs, which benefits you as a stockholder. In addition, when you vote by proxy online or by phone prior to the meeting date, your proxy vote is recorded immediately, and there is no risk that postal delays will cause your proxy vote to arrive late and, therefore, not be counted. For further instructions on voting by proxy, see the enclosed proxy card accompanying this proxy statement.

|

If you attend the annual meeting and vote at such time, we urge you to have your proxy vote recorded in advance of the annual meeting. Stockholders have the following three options for submitting their votes by proxy in advance of the meeting: (1) online; (2) by phone; or (3) by mail, using the enclosed proxy card (if you received a paper copy of the proxy materials). For further instructions on voting by proxy, see the proxy card accompanying this proxy statement.

DIRECTOR NOMINEES We have included summary information about each director nominee in the table below. Each director is elected annually by a majority of votes cast. See “Corporate Governance” beginning on page 7 and “Your Board of Directors” beginning on page 14 for more information regarding our directors and our process for nominating directors. | Name and Primary Occupation | | | Age | | | Director

Since | | | Independent | | | AC | | | CC | | | FC | | | NC | | | | | Tim E. Bentsen Retired Partner

KPMG LLP | | | 68 | | | 2020 | | | ✓ | | | C

FE | | | | | | ✓ | | | | | | | | Brian M. Davis CEO and President

CatchMark Timber

Trust, Inc. | | | 52 | | | 2020 | | | | | | | | | | | | ✓ | | | | | | | | James M. DeCosmo Retired CEO and

President Forestar

Group Inc. | | | 63 | | | 2020 | | | ✓ | | | | | | | | | ✓ | | | C | | | | | Paul S. Fisher Retired Vice Chairman,

President and CEO

CenterPoint Properties Trust | | | 66 | | | 2016 | | | ✓ | | | | | | ✓ | | | C | | | ✓ | | | | | Mary E. McBride Retired President

CoBank, ACB | | | 66 | | | 2018 | | | ✓ | | | ✓ FE | | | C | | | | | | ✓ | | | | | Douglas D. Rubenstein – Chairman Executive Vice President,

Chief Operating Officer and

Director of Capital Markets

Benjamin F. Edwards & Company | | | 59 | | | 2013 | | | ✓ | | | ✓ | | | ✓ | | | | | | ✓ | |

| | AC = Audit Committee CC = Compensation Committee FC = Finance and Investment Committee | | | NC = Nominating and Corporate Governance Committee C = Committee Chair FE = Financial Expert | |

We continued to execute our strategy of owning and operating prime timberlands located in leading mill markets and optimizing harvest operations through delivered wood sales and opportunistic stumpage sales in 2021. During the year, we achieved our operating performance targets and further improved our capital position and leverage profile, all while making significant progress in furthering our long-term strategic objectives. Our fiber supply agreements, delivered wood model and opportunistic stumpage sales were primary performance drivers, generating stable and predictable cash flows that, combined with revenues from opportunistic land sales and asset management fees, covered recurring dividends to our stockholders. We continued to actively manage our timberlands to achieve an optimum balance among biological timber growth, current harvest cash flow, and responsible environmental stewardship. Some of our key accomplishments for 2021 include the following: •

Realized Net Income. Realized net income of $58.4 million, or $1.20 per diluted share, compared to a net loss of $17.5 million in 2020. •

Achieved High End of Adjusted EBITDA Guidance Range. Achieved Adjusted EBITDA* of $49.4 million, at the higher-end of the Company’s guidance range for 2021, a decrease from $52.1 million in 2020, primarily due to a $1.4 million decrease in net timberland sales, which was the result of selling fewer acres. •

Increased Product Pricing. Achieved U.S. South timber sales pricing 17% and 14% higher than 2020 for pulpwood and sawtimber, respectively, driven by strong market fundamentals. Pulpwood and sawtimber stumpage prices for the year also may submit your voterealized 54% and 20% premiums over U.S. South-wide averages, reflecting the concentration of our prime timberlands located in person,high-demand markets. •

Record Cash Flow from Operations. Generated a record $47.2 million of net cash provided by operating activities, 17% higher than cash provided by operating activities of $40.5 million in 2020. •

Consistent Cash Available for Distribution. Produced consistent cash available for distribution (“CAD”)* of $34.1 million compared to $34.8 million in 2020. •

Paid Fully Covered Dividends. Paid total cash distributions of $23.3 million to stockholders fully covered by cash flow from operations of $47.2 million and CAD of $34.1 million. For additional information regarding our 2021 accomplishments, see “Executive Compensation — Compensation Discussion and Analysis — Executive Summary — 2021 Company Performance Highlights” beginning on page 23. *

Adjusted EBITDA and CAD are non-GAAP measures. See Appendix A for an explanation of these non-GAAP measures, a reconciliation of these measures to GAAP net income (loss) and cash provided by operating activities, respectively, and a brief discussion of why we use these measures. Environmental, Social and Governance Highlights Environmental CatchMark seeks to maximize long-term returns by actively managing our timberlands to achieve an optimum balance among biological timber growth, current harvest cash flow, and responsible environmental stewardship. •

Sustainably-Managed Timberlands. We are dedicated to meeting the highest standards in forestry, measured through forest certifications. We are proud that 100% of our fee timberlands are certified as a sustainable forest according to the high standards of the Sustainable Forestry Initiative® (SFI). We voluntarily maintain the rigorous standards required to be certified by SFI, working with third-party independent auditors to ensure our practices measure up to these standards. SFI standards promote sustainable forest management through recognized core principles, including measures to protect water quality, biodiversity, wildlife habitat and at-risk species. •

Millions of Trees Planted. Since 2013, we have planted more than 65 million trees, including over eight million in 2021. We plant four seedlings for every tree that we harvest (excluding thinning operations). •

Inaugural ESG and Carbon Reports. In 2021, we published our inaugural ESG report,

demonstrating our commitment to ESG best practices and standards, including disclosure regarding those practices. We also published our first carbon report in which we disclosed both our Scope 1, 2 and 3 carbon emissions as well as the carbon sequestered by our forests, demonstrating the net positive impact that we believe our timberlands have with respect to climate change. •

Forestry Wildlife Partnership. We have been a member of the Forestry for Wildlife Partnership for Georgia since 2010. In 2021, we were again recognized as a Forestry Wildlife Partner by the Georgia Department of Natural Resources’ Wildlife Resources Division and the Governor of Georgia for our stewardship and land management practices benefiting Georgia’s wildlife, in particular our work on the Sprewell Bluff Wildlife Management Area to enhance the forest habitat for the endangered red-cockaded woodpecker. •

Stream Restoration. Through our Dawsonville Bluffs joint venture, we own and manage two mitigation banks located in North Georgia that preserve 17.6 miles of stream, of which 8.5 miles of stream has been restored, improving habitat for sensitive and endangered species including the Etowah crayfish and holiday darter. •

Rare and Endangered Species Protected. We have a process for identifying populations of known threatened, endangered, and rare species and all field personnel have training in species identification and their habitats. In our South Central region we have occurrences of Fringed Campion and Trillium, both endangered plants, and we developed and follow management plans to protect these species. Social We care about our employees and recognize that they are key to our success. Our Compensation Committee has oversight for our policies and strategies regarding human capital management and has determined that the policies and strategies discussed below are important to the Company’s performance. •

Protection from Harassment, Discrimination and Retaliation. We believe that all individuals should be treated with dignity and respect, and have adopted a Human Rights Policy that, among other things, includes a No Harassment Policy that does not tolerate discriminatory harassment of any sort, including based on race, color, religion, sex, national origin, age, disability, pregnancy, childbirth, or related medical conditions, gender identity, sexual orientation, genetic information, citizenship status, service member status or any other characteristic protected by federal, state or local anti-discrimination laws. We also value and protect an employee’s right to raise workplace issues without concern for retaliation. We believe our employee relations are good and we have policies and procedures in place to quickly address and remedy employee grievances and any previous proxy votesworkplace disputes. •

Diversity and Inclusion. We value diversity in the workplace. As of December 31, 2021, 50% of our executive officers were women and 57% of our total number of employees were women. Approximately 24% of our workforce is comprised of individuals that you submitted, whether online, by phoneidentify as a member of an ethnic or by mail,racial minority group, including approximately 10% identifying as Asian, 10% identifying as Black and 5% identifying as Hispanic or Latino. •

Health and Safety. We are committed to providing and maintaining a safe and healthy workplace for all workers (including vendors, contractors, temporary employees and volunteers) as well as clients, visitors and members of the public. Risks and hazards to health and safety will be superseded byeliminated or minimized, as far as is reasonably practicable. We have adopted a Health and Safety Policy in furtherance of this commitment. During the vote you cast atyear ended December 31, 2021, as a result of the annual meeting.COVID-19 pandemic, we maintained safety protocols to protect our employees and others, including protocols regarding social distancing, health checks and working remotely. Our experienced teams continued to successfully manage our business during this challenging time. •

Q: What if I vote by proxyBenefits, Training and then change my mind?Professional Development. We provide high-quality benefits to our employees, including equity grants for all employees, healthcare and wellness initiatives, and a 401(k) plan with a generous Company match, time-off for volunteering, a charitable matching program, and a scholarship

program for children of non-executive employees. We also provide regular training and professional development opportunities for our employees. These include semi-annual, company-wide information security training programs, as well as personal coaching for all officers and executives, and opportunities to attend conferences and other events relevant to the timberland, forest products and REIT industries. During 2021, our employees participated in over 360 hours of training and education programs, or an average of approximately 16 hours per employee. •

Low Average Turnover Rate. We believe that all of our initiatives to make CatchMark an exceptional place to work have resulted in our low historic turnover rate, which averaged 9.7% annually over the past three years. In 2021, our turnover rate was 17.4%, which was higher than average due to the departure of four employees, three of whom had been dedicated to the Triple T joint venture, which we exited in October 2021. While our 2021 turnover rate was higher than our historical average, it was still well below the total turnover rate for the United States for 2020 of 57.3% and the turnover rate for financial activities for 2020 of 31.3%, according to the Bureau of Labor Statistics. Governance Our corporate governance policies promote the long-term interests of stockholders, accountability and trust in us. Below is a summary of some of the highlights of our corporate governance framework. | | | A:Annual election of all directors Majority voting with plurality carve out for contested elections Five of six directors are independent Separate independent Chairman and CEO Anti-hedging and anti-pledging policy Executive officer stock ownership guidelines Independent director stock ownership guidelines Regular executive sessions of independent directors Related person transactions policy Annual say-on-pay advisory votes | You | | Average director tenure of 4.5 years Risk oversight by the board and committees Annual board and committee self-evaluations No supermajority voting No stockholder rights plan Stockholders have ability to amend the right to revoke your proxybylaws Board diversity policy Director continuing education policy All directors attended at any time before the meeting by:least 75% of 2021 meetings Stockholder engagement | |

(1) notifying John F. Rasor, our Chief Operating Officer and Secretary;

(2) attending the meeting and voting in person;

| | (3) | returning another properly executed proxy card dated after your first proxy card if we receive it before the annual meeting date; or |

| | (4) | recasting your proxy vote online or by phone. |

Only the most recent proxy vote will be counted, and all others will be discarded regardless of the method of voting.

Q: Will my vote make a difference?

| | A: | Yes. As discussed below, your vote could affect the composition of our board of directors. Moreover, your presence by proxy or in person is needed to ensure that we can act on the proposals presented. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

|

Q: How does the board of directors recommend I vote on the proposals?

| | A: | The board of directors recommends a vote: |

FOR the election of the seven nominees named in this proxy statement to serve on our board of directors;Executive Compensation Highlights

FOR•

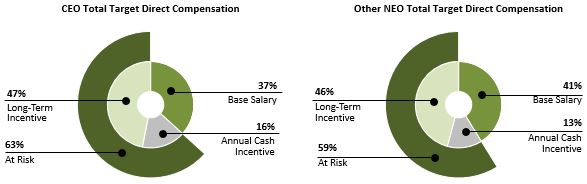

Our executive compensation programs are designed to align the approval, on an advisory basis,interests of our executive officers with those of our stockholders. We believe that our compensation programs encourage executive decision-making that is aligned with the long-term interests of our stockholders by tying a significant portion of our executives’ pay to our performance. •

Our compensation program is comprised of three primary elements: base salary, annual cash incentive awards and long-term equity incentive awards. •

A significant portion of our named executive officers;officers’ 2021 target total direct compensation was “at-risk” — 72% for our CEO and 61% for our other named executive officers — which the Compensation Committee believes aligns our executive officers’ interests with the interests of our stockholders and encourages longer-term value creation for our stockholders. FOR•

Consistent with the proposalCompensation Committee’s commitment to ratify“at-risk” pay that aligns the appointmentinterest of Deloitte as our independent registered public accounting firmexecutives with our stockholders, the Compensation Committee did not make any adjustments to the rigorous performance goals for the fiscal year ended2019 performance-based long-term incentive awards, which had a three-year performance period ending in December 31, 2016.2021 and were ultimately forfeited by our executives. •

Q: What are the voting requirements to elect the board70% of directors?

| | A: | The affirmative vote of a majority of the total votes cast for and against a nominee at a meeting of stockholders duly called and at which a quorum is present is required for the election of our directors. Abstentions and broker non-votes do not count as votes cast and therefore will not have any effect on the election of the directors. Please see “Proposal No. 1: Election of Directors.” |

| | Q: | What are the voting requirements to approve, on an advisory basis, the compensation of our named executive officers? |

| | A: | The affirmative vote of a majority of the votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient to approve, on an advisory basis, the compensation of our named executive officers. Abstentions and broker non‑votes do not count as votes cast and therefore will not have any effect on the outcome of this proposal. The vote is advisory, and therefore not binding on us, our board of directors or the Compensation Committee of our board of directors (the “Compensation Committee”). The Compensation Committee, however, will review the voting results and take them into consideration when making future decisions regarding executive compensation as it deems appropriate. Please see “Proposal No. 2: Advisory Vote to Approve Named Executive Officer Compensation.” |

| | Q: | What are the voting requirements to ratify the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2016? |

| | A: | The proposal to ratify the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2016 requires the affirmative vote of a majority of the votes cast at a meeting of stockholders duly called and at which a quorum is present. Abstentions will not be counted as having been cast and will have no effect on the outcome of this proposal. Broker non‑votes will not arise in connection with, and will have no effect on the outcome |

of, this proposal because brokers may vote in their discretioneach named executive officer’s (“NEO”) 2021 annual cash incentive award opportunity was based on behalf of clients who have not furnished voting instructions. Even if the selection is ratified, the Audit Committeeour achievement of our boardAdjusted EBITDA, Harvest EBITDA and Leverage targets. The remaining 30% was based on the Compensation Committee’s assessment of directors (the “Audit Committee”) in its discretion may directeach NEO’s individual performance against objective, measurable goals.

•

At our 2021 annual meeting of stockholders, we were pleased to receive approximately 98% support for our executive compensation program.

Internet Availability of Proxy Materials We have elected to deliver our proxy materials to the appointmentmajority of our stockholders using the “notice-and-access” method permitted by SEC rules. Under notice-and-access, instead of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests. Please see “Proposal No. 3: Ratification of Appointment of Independent Registered Public Accounting Firm.”

| | Q: | How will voting on any other business be conducted? |

| | A: | Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business is properly presented at the annual meeting, your signed proxy card or proxy submitted by phone or online gives authority to Messrs. Barag, Davis, and Rasor, and each of them, to vote on such matters in accordance with the recommendation of our board of directors or, in the absence of such a recommendation, in their discretion. |

| | Q: | Where can I find the voting results of the annual meeting? |

| | A: | The preliminary voting results will be announced at the annual meeting. In addition, within four business days following the meeting, we intend to file the final voting results with the SEC on Form 8‑K. If the final voting results have not been certified within that four‑day period, we will report the preliminary voting results on Form 8‑K at that time and will file an amendment to the Form 8‑K to report the final voting results within four business days of the date that the final results are certified. |

| | Q: | When are stockholder proposals for the 2017 annual meeting of stockholders due? |

| | A: | Stockholders interested in nominating a person as a director or presenting any other business for consideration at our 2017 annual meeting of stockholders may do so by following the procedures prescribed in Article II, Section 11 of our bylaws and in Rule 14a‑8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for presentation to and action by the stockholders at the 2017 annual meeting, director nominations and other stockholder proposals must be received by our Secretary, no earlier than December 10, 2016 and no later than 5:00 pm, ET, on January 9, 2017. To also be eligible for inclusion in our proxy statement for the 2017 annual meeting of stockholders, stockholder proposals must be received by our Secretary by January 9, 2017. However, if we hold the 2017 annual meeting before May 25, 2017 or after July 24, 2017, stockholders must submit proposals for inclusion in our 2016 proxy statement within a reasonable time before we begin to print our proxy materials. |

| | Q: | Who pays the cost of this proxy solicitation? |

| | A: | We will pay all the costs of soliciting these proxies. We have retained Georgeson Inc., a Delaware corporation operating under the name Computershare Fund Services (“Computershare”), to assist us in the distribution of proxy materials and the solicitation of proxies. We expect to pay Computershare fees of approximately $10,000 to solicit proxies plus other fees and expenses for other services related to this proxy solicitation, which include review of certain proxy materials, dissemination of brokers’ search cards, distribution of notices of Internet availability of proxy materials, distribution of proxy materials, operating online and phone voting systems, and receipt of executed proxies. We also will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Our officers and directors may also solicit proxies, but they will not be specifically compensated for these services. |

| | Q: | Is this proxy statement the only way that proxies are being solicited? |

| | A: | No. In addition to mailing a Notice Regarding Availability of Proxy Materials on or about May 9, 2016 and mailing or providing access to these proxy solicitation materials, our directors and employees, as well as Computershare and any other third‑party proxy service companies we retain, also may solicit proxies in person, over the Internet, by phone or by any other means of communication we deem appropriate. |

| | Q: | If I share my residence with another stockholder, how many copies of the annual report and proxy statement should I receive? |

| | A: | In accordance with SEC rules, we are sending only a single set of the annual report and proxy statement to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family, unless we have received instructions to the contrary from any stockholder at that address. This practice |

is known as “householding” and is permitted by rules adopted by the SEC. This practice reduces the volume of duplicate information received at your household and helps us reduce costs, which benefits you as a stockholder. Each stockholder will continue to receive a separate proxy card or voting instruction card. We will deliver promptly, upon written or oral request, a separatepaper copy of the annual report orproxy materials, we are sending those stockholders a Notice Regarding the Availability of Proxy Materials (the “Notice”). The Notice contains instructions on how to:

•

electronically access our proxy statement as applicable,for our 2022 Annual Meeting of Stockholders, our 2021 Annual Report to Stockholders and a stockholder at a shared address to which a single copyform of the documents was previously delivered. If you received a single set of these documents for your household for this year, but you would prefer to receive your own copy, you may direct requests for separate copies to the following address: CatchMark Timber Trust, Inc., c/o Computershare Inc., Computershare Fund Services, P.O. Box 18011, Hauppauge, New York 11788‑8811,proxy; and •

vote via internet, by telephone or call us at 1‑866‑956‑7277. If you are a stockholder who receives multiple copiesby mail. Electronic delivery of our proxy materials you may request householding by contactingwill allow us into provide stockholders with the information they need more quickly and efficiently, while at the same manner and requesting a householding consent form.

| | Q: | What if I consent to have one set of materials mailed now but change my mind later? |

| | A: | You may withdraw your householding consent at any time by contacting Computershare at the address and phone number provided above. We will begin sending separate copies of stockholder communications to you within 30 days of receipt of your instruction. |

| | Q: | The reason I receive multiple sets of materials is because some of the shares belong to my children. What happens if they move out and no longer live in my household? |

| | A: | When we receive notice of an address change for one of the members of the household, we will begin sending separate copies of stockholder communications directly to the stockholder at his or her new address. You may notify us of a change of address by contacting Computershare at 1-855-862-0044. |

| | Q: | If I plan to attend the annual meeting in person, should I notify anyone? |

| | A: | While you are not required to notify anyone in order to attend the annual meeting, if you do plan to attend the meeting, we would appreciate it if you would mark the appropriate box on the enclosed proxy card or when you submit your proxy by phone or online, which will enable us to determine the number of stockholders attending the meeting and to provide a suitable meeting room for the attendees. |

| | Q: | Where can I find more information? |

| | A: | You may access, read and print copies of the proxy materials for the annual meeting, including this proxy statement, form of proxy card and annual report to stockholders, at the following website: www.catchmark.com/proxy.

|

time lowering our cost of delivery. We file annual, quarterly, and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information we file with the SEC on its website at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street N.E., Washington, D.C. 20549. You also may obtainmailing paper copies of the documents at prescribed rates by writingproxy materials to the Public Reference Section of the SEC at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1‑800‑SEC‑0330 for further information regarding the public reference facilities.stockholders who have requested to receive them in paper form.

BOARD> CORPORATE GOVERNANCE The Board of Directors

Our board of directors has oversight responsibility for our operations and makesapproves all major decisions concerning our business. Our board of directors is also responsible for monitoring our operating results, financial condition and our significant risks. Our board of directors employs practices that foster effective board oversight, including regular reviews of our major governance documents, policies and processes in the context of current corporate governance trends, regulatory changes and recognized best practices. The following sections provide an overview of our corporate governance structure and processes, including key aspects of our board operations. Selecting Director Nominees and Board Refreshment Our board of directors is responsible for selecting its nominees and recommending them for election by the stockholders. The board delegates the screening process necessary to identify qualified candidates to the Nominating and Corporate Governance Committee (the “Nominating Committee”). The Nominating Committee annually develops a slate of director nominees who are then recommended to and voted on by our full board of directors. Nominees are then proposed by the board to the stockholders for election. All director nominees stand for election by our stockholders annually. In developing a slate of nominees, the Nominating Committee annually reviews with our board of directors the appropriate experience, skills and characteristics required of board members in the context of the then-current membership of our board. This assessment includes, in the context of the perceived needs of our board of directors at that time, issues of knowledge, experience, judgment and skills such as an understanding of the timber, forest products or real estate industries, capital markets, accounting or financial management expertise, as well as gender, race and ethnicity. Our board of directors and the Nominating Committee seek a diverse board of directors whose members collectively possess these skills and experiences. Our board places high importance on diversity and has adopted a policy that each pool of candidates from which board nominees are chosen must include candidates with a diversity of gender, race and ethnicity, a process which is overseen by our Nominating Committee. The Nominating Committee and the board continue to actively seek to develop a board that is more diverse. Other factors considered by the Nominating Committee in developing a slate of nominees include the candidate’s independence from conflict with us and the ability of the candidate to attend board meetings regularly and to devote an appropriate amount of effort in preparation for those meetings. It also is expected that independent directors nominated by our board of directors will be individuals who possess a reputation and hold or have held positions or affiliations befitting a director of a public company and are or have been actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. To identify potential director nominees, the Nominating Committee solicits candidate recommendations from its own members and our management. The Nominating Committee may also engage the services of a search firm to assist in identifying potential director nominees. The Nominating Committee also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In evaluating the persons recommended as potential directors, the Nominating Committee will consider each candidate without regard to the source of the recommendation and take into account those factors that the Nominating Committee determines are relevant. Stockholders may directly nominate potential directors (without the recommendation of the Nominating Committee) by satisfying the procedural requirements for such nomination as provided in Article II, Section 11 of our bylaws.

Any stockholder may request a copy of our bylaws free of charge by contacting our Secretary at our headquarters: | | | | | CatchMark Timber Trust, Inc.

5 Concourse Parkway, Suite 2650,

Atlanta, Georgia 30328 | | | | | | | 855-858-9794

(Atlanta area: 404-445-8480) | | | | | | | info@catchmark.com | |

Current Board Composition The chart below highlights the experience and qualifications of our nominees to the Board, as well as their gender, race or ethnicity and length of service on our board of directors. In 2021, we completed two large dispositions and exited the Triple T joint venture, and as a result, we are a smaller company now than we were previously. We currentlybelieve these transactions were critical to strengthening our balance sheet and positioning the Company for future growth. However, because we are a smaller company now, we have eight directors. However, Alan D. Gold is not standing for re-election andyet deemed it appropriate to increase the size of our board of directors. As we execute our growth strategy, which includes both near-term cash accretive acquisitions, portfolio accretive acquisitions and environmentally focused income opportunities, we also expect to expand our board of directors, and we will seek directors with skills and experience to help us achieve this strategy. Pursuant to our previously adopted board diversity policy, the pool of potential director candidates will include people with gender and ethnic or racial diversity, and we intend for the next director that we elect to our board of directors to be reduced to seven following the annual meeting. We have provided below certain information about our directorsa man or woman that are standing for re-election.is a member of an ethnic or racial minority. | | Director | | | CEO/Senior

Management

Experience | | | Timber/

Real Estate

Experience | | | Capital

Markets/

Finance

Experience | | | Audit

Committee

Financial

Expert | | | Gender | | | Race/

Ethnicity | | | Length of Service | | | | Tim E. Bentsen | | | X | | | | | | X | | | X | | | M | | | White | | | 2 years | | Name | AgeBrian M. Davis | | Position(s) | X | Term of Office | | X | | | X | | | | | | M | | | White | | | 2 year, 4 months | | Willis J. Potts, Jr.

| 69James M. DeCosmo | | Chairman of the Board | X | Since 2006 | | X | | | X | | | | | | M | | | White | | | 2 years | | | | Paul S. Fisher | 60 | | Independent DirectorX | | Since 2016 | X | | | X | | | | | | M | | | White | | | 6 years, 3 months | | Donald S. Moss | 80Mary E. McBride | | Independent Director | X | Since 2006 | | X | | | X | | | X | | | F | | | White | | | 4 years, 2 months | | | | Douglas D. Rubenstein | 53 | | Independent DirectorX | | Since 2013 | Henry G. Zigtema | 64X | | Independent Director | X | Since 2012 | Jerry Barag | 57 | | Chief Executive Officer, President and Director | | Since 2013 | John F. RasorM | 72 | | Chief Operating Officer, Secretary and DirectorWhite | | Since 2013 | 8 years,4 months | |

Director Independence There are no family relationships between any directors or executive officers, or between any director and executive officer.

Willis J. Potts, Jr. has served as our ChairmanFive of the Board since November 2013 and as onesix current members of our independent directors since 2006. From 1999 until his retirement in 2004, Mr. Potts served as Vice President and General Manager of Temple‑Inland Inc., a major forest products corporation, where he was responsible for all aspects of the management of a major production facility, including timber acquisition, community relations and governmental affairs. From 1994 to 1999, Mr. Potts was Senior Vice President of Union Camp Corporation, where he was responsible for all activities of an international business unit with revenues of approximately $1 billion per year, including supervision of acquisitions and dispositions of timber and timberland, controllership functions and manufacturing. From 2004 to 2007, Mr. Potts served as the chairman of the board of directors and all of the Technical Associationmembers of the PulpAudit Committee, the Compensation Committee and Paper Industry (TAPPI)the Nominating Committee are “independent” as defined by the New York Stock Exchange (“NYSE”), and a majority of the largest technical association servingmembers of the pulp, paperFinance and converting industry. From 2006Investment Committee (the “Finance Committee”) meet the NYSE’s definition of independence. The NYSE listing standards provide that to 2012, Mr. Potts served on the Boardqualify as an independent director, in addition to satisfying certain bright-line criteria, our board of Regents of The University System of Georgia. Mr. Potts also servesdirectors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder, or officer of an organization that has a relationship with us). From time to time we may have ordinary course of business relationships with companies with which our directors are associated. Our board of directors considers such transactions in connection with its director of J&J Industries, a privately held carpet manufacturing company. Mr. Potts received a Bachelor of Science in Industrial Engineering from the Georgia Institute of Technology. He also completed the Executive Program at the University of Virginia.independence

determinations. Our board of directors has determined that Mr. Potts’ extensive experience in the acquisition and dispositioneach of timber and timberland, combined with his experience serving as a director of, and otherwise managing, organizations engaging in these activities, enable Mr. Potts to effectively carry out his duties and responsibilities as director. Tim E. Bentsen, James M. DeCosmo, Paul S. Fisher, has served Mary E. McBride and Douglas D. Rubenstein qualifies as onean independent director under the listing standards of our independent directors since January 2016. Mr. Fisher was the President andNYSE. Brian M. Davis is our Chief Executive Officer of CenterPoint Properties Trust (“CenterPoint”), a developer, investor and manager of supply chain industrial assetsPresident, and related transportation infrastructure, from 2011the board does not consider him to 2013. Mr. Fisher co‑founded a predecessorbe an independent director. In addition to CenterPoint in 1991 and served as General Counsel and Chief Financial Officer before being appointed President in 2004. CenterPoint was a publicly traded REIT from 1993 to 2006, when it was privatized by a joint venturethe independence requirements discussed above, members of the California Employees Retirement System and LaSalle Investment Management, Inc. Mr. Fisher continues to serve as a director of CenterPoint. Before joining CenterPoint, Mr. Fisher was a Vice President of Finance and Acquisitions at Miglin‑Beitler Inc., a Chicago-based office developer. Prior to that, Mr. Fisher served as Vice President of Corporate Finance at The First National Bank of Chicago and as a Vice President of Partnership Finance at VMS Realty, a Chicago‑based real estate syndication company. Mr. Fisher serves onAudit Committee also must satisfy additional independence requirements established by the U.S. Department of Commerce Advisory Council on Supply Chain CompetitivenessSEC and the Advisory BoardNYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from us or any of the Supplyour subsidiaries other than their directors’ compensation and Value Chain Centerthey may not be affiliated with us or any of Loyola University. Mr. Fisher received a Bachelor of Arts in Economics from The University of Notre Dame and a Doctor of Law from The University of Chicago School of Law. our subsidiaries. Our board of directors has determined that Mr. Fisher’s extensive experienceall of the members of the Audit Committee satisfy

the relevant SEC and NYSE independence requirements. Further, in real estate investment andaffirmatively determining the independence of any director who will serve on the Compensation Committee, our board also considers all factors specifically relevant to determining whether a director has a relationship to us that is material to that director’s ability to be independent from management particularly his experience serving as presidentin connection with the duties of and otherwise managing, a major publicly traded REIT, provides him with skills and knowledge that enable him to effectively carry out his duties and responsibilities as a director. Donald S. Moss has served as one of our independent directors since 2006. He was employed by Avon Products, Inc. from 1957 until his retirement in 1986. While at Avon, Mr. Moss served in a number of key positions, including Vice President and Controller from 1973 to 1976, Group Vice President of Operations-Worldwide from 1976 to 1979, Group Vice President of

Sales-Worldwide from 1979 to 1980, Senior Vice President-International from 1980 to 1983 and Group Vice President-Human Resources and Administration from 1983 until his retirement in 1986. Mr. Moss was also a member of the Compensation Committee, including the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by us to such director and whether the director is affiliated with us, our subsidiaries or our affiliates.

Our board has determined that all of the members of the Compensation Committee satisfy this additional independence requirement. Meetings of Independent Directors To promote the independence of our board of directors and appropriate oversight of Avon Canada, Avon Japan, Avon Thailand and Avon Malaysia from 1980 to 1983. Mr. Moss is a past president and former director of The Atlanta Athletic Club, a former director of the Highlands Country Club in Highlands, North Carolina and the National Treasurer and a former director of the Girls Clubs of America. Mr. Moss attended the University of Illinois. Our board of directors has determined that Mr. Moss’s experience serving as a director for other organizations, including a publicly traded REIT, provides him with the business management, skills and real estate knowledge desired to effectively carry out his duties and responsibilities as director.

Douglas D. Rubenstein has served as one of our independent directors since December 2013.meet in executive sessions at which only independent directors are present. During these sessions, Mr. Rubenstein, has served as Senior Vice President and Director of Capital Markets and Business Strategy for Benjamin F. Edwards & Company, Inc., a private, full‑service broker‑dealer, since June 2012. From 2007 to June 2012, he held various positions in the Real Estate Investment Banking Group of Stifel, Nicolaus & Company, Inc., including Managing Director from 2007 to August 2008, Co‑Group Head from August 2008 to December 2008 and Managing Director and Group Head from January 2009 to June 2012. From 1985 to 2007, he served in a variety of roles in the Capital Markets Division of A.G. Edwards & Sons, Inc., a U.S.‑based financial services company that was acquired by Wachovia Corporation (now Wells Fargo & Company) in 2007, and was promoted from Analyst ultimately to Managing Director and Real Estate Group Coordinator. Mr. Rubenstein currently serves as a trustee at Whitfield School and previously served as aindependent director and Chairman of the Board, of Life Skills, a non‑profit organization, for 16 years. He holds Series 7 (grandfathered into Series 79), 24 and 63 licenses and was formerly a member ofpresides. These meetings are held in conjunction with the National Association of Real Estate Investment Trusts (“NAREIT”). Mr. Rubenstein received a Bachelor of Arts in Economics from Lake Forest College and a Master of Business Administration from the John M. Olin School of Business at Washington University.

Our board of directors has determined that Mr. Rubenstein’s extensive experience in the real estate industry and, specifically, raising capital for real estate companies, provides him with skills and knowledge that enable him to effectively carry out his duties and responsibilities as a director.

Henry G. Zigtema has served as one of our independent directors since September 2012. Prior to his retirement in 2006, Mr. Zigtema spent 28 years with Ernst & Young LLP (“Ernst & Young”) and its predecessor firm, Arthur Young and Company. From 2001 to 2006, Mr. Zigtema was the Southeast Area Tax Managing Partner for Ernst & Young’s Real Estate Practice. During his career, Mr. Zigtema served in several key positions, including Area Director of Tax, Plains State Area Industry Leader for Telecommunications, Oil and Gas, and Real Estate as well as a National Office Partner for Strategic Business Services. Mr. Zigtema served as the tax engagement partner or client service partner for a wide variety of clients, including multinational companies such as Sprint, Zion’s Bank, US Bank, Piedmont REIT, Columbia Property Trust, Inc. (“Columbia”), various publicly traded REITs in the retail, office, apartment and mortgage spaces, as well as a number of private clients. Past board of director involvement includes Maur Hill Prep School, Kapaun Mt. Carmell High School, St. Thomas Aquinas School, Wichita State Accounting Conference Committee, Sedgewick County Zoo and Ronald McDonald House. Mr. Zigtema is currently the chair of the Finance Committee for the Robert W. Woodruff Library. Mr. Zigtema has been an adjunct professor of accounting at Oglethorpe University (“Oglethorpe”) and currently serves on the President’s Advisory Board at Oglethorpe. Mr. Zigtema has contributed to various Ernst & Young publications and was a member of NAREIT. Mr. Zigtema received a Bachelor of Arts in mathematics from Texas Christian University and a Juris Doctorate from Southern Methodist University. He also completed non‑degree accounting classes at the University of Texas at Dallas. Mr. Zigtema is a Certified Public Accountant with permits to practice in Georgia, Kansas and Texas and is an inactive member of the Texas Bar.

Our board of directors has determined that Mr. Zigtema’s extensive accounting and tax background and experience serving as a director for other organizations enable Mr. Zigtema to effectively carry out his duties and responsibilities as director.

Jerry Barag has served as our Chief Executive Officer and President since our transition to self-management on October 25, 2013 and became a director on December 17, 2013. Mr. Barag served as our consultant from August 2013 to his appointment as our Chief Executive Officer and President. Mr. Barag brings over 30 years of real estate, timberland and investment experience, including expertise in acquisitions, divestitures, asset management, property management and financing. From September 2011 to our transition to self‑management, Mr. Barag has served as a Principal with Mr. Rasor of TimberStar Advisors, an Atlanta‑based timberland investment consulting firm, where he specialized in acquiring and managing timberlands in the United States. From 2004 to September 2011, he served as Managing Director of TimberStar, a timberland investment joint venture among himself, Mr. Rasor, iStar Financial, Inc. and other institutional investors. While at TimberStar, he oversaw the acquisition of over $1.4 billion of timberlands in Arkansas, Louisiana, Maine and Texas. From 2003 to 2004, he served as Chief Investment Officer of TimberVest, LLC (“TimberVest”), an investment manager specializing in timberland investment planning. Prior to joining TimberVest, Mr. Barag served as Chief Investment Officer and Chairman of the Investment Committees for Lend Lease, a subsidiary of Lend Lease Corp., a construction, development and real estate investment management advisory company traded

on the Australian Securities Exchange. Mr. Barag received his Bachelor of Science from The University of Pennsylvania, Wharton School.

Our board of directors has determined that Mr. Barag’s extensive experience acquiring and managing timberlands and commercial real estate enable him to effectively carry out his duties and responsibilities as director.

John F. Rasor has served as our Chief Operating Officer and Secretary since our transition to self‑management on October 25, 2013 and became a director on December 17, 2013. Mr. Rasor served as our consultant from August 2013 to his appointment as our Chief Operating Officer and Secretary. Mr. Rasor brings over 45 years of experience in the timberland and forest products industries, including expertise in manufacturing, fiber procurement and log merchandising, sales and distribution. From September 2011 to our transition to self‑management, Mr. Rasor served as a Principal with Mr. Barag of TimberStar Advisors. From 2004 to September 2011, he served as Managing Director of TimberStar. During his 40‑year career with Georgia‑Pacific Corporation (“Georgia‑Pacific”), Mr. Rasor served as an Executive Vice President of Georgia‑Pacific from 1996 to 2003, where he was responsible for all of Georgia‑Pacific’s timberland and the procurement of all the wood and fiber needed to operate Georgia‑Pacific’s mills. He also played a key role in the separation of Georgia‑Pacific’s timberland assets into a separate operating entity in 1997 that subsequently merged with Plum Creek Timber Company, Inc. in 2001. Following the separation of Georgia‑Pacific’s timberland assets, Mr. Rasor assumed responsibility for several of Georgia‑Pacific’s building products business units and staff positions in addition to serving as a member of the Executive Management Committee of the company. Mr. Rasor attended Willamette University and the University of Oregon.

Our board of directors has determined that Mr. Rasor’s extensive experience in the forest products industry, including the management of timberland operations and the procurement of wood fiber, will enable him to effectively carry out his duties and responsibilities as a director.

Director Attendance at Meetings

During 2015, our board of directors held nine meetings, either in person or telephonically. Each of our directors attended at least 75% of the aggregate of the total number ofregularly scheduled quarterly meetings of our board of directors held during the period for which he served as a director and the total number of meetings heldbut may be called at any time by all committees of our independent directors. Our board of directors on which he served duringmay modify this structure if it determines that a different structure is in the periods for which he served. Although we have no policy with regard to attendance by the membersbest interest of our board of directors at our annual meetings of stockholders, we invite and encourage the members of our board of directors to attend our annual meetings to foster communication with stockholders. In 2015, five of our seven directors serving at that time attended the annual meeting of stockholders.

Board Leadership Structure Our board of directors is currently led by Willis J. Potts, Jr.,Douglas D. Rubenstein, as Chairman of the Board, who is an independent director. We currently separatehave separated the positions of Chief Executive Officer and Chairman of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for our strategic direction, day‑to‑dayday-to-day leadership and performance while the Chairman of the Board, in consultation with the Chief Executive Officer, sets the agenda for and presides over meetings of our board of directors. In addition, we believe that the separation provides a more effective monitoring and objective evaluation of the Chief Executive Officer’s performance. The separation of these leadership roles also allows the Chairman of the Board to strengthen our board’s independent oversight of our performance and governance standards. Another key component of our board’s leadership structure is the role of its committees. Our board of directors has delegated certain oversight functions to its four standing committees — the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, (the “Nominating Committee”) and the Finance and Investment Committee (the “Finance Committee”), each of which is comprised entirely of independent directors, and the Finance Committee, of which a majority of the members are independent directors. These committees regularly report back to our board of directors with specific findings and recommendations in their areas of oversight and also coordinateconsult and work with the Chief Executive Officer and other members of management. Further information about these four committees is provided in “Your Board of Directors — Board Committees.” We believe that our board’s leadership structure, policies, and practices, when combined with our other governance policies and procedures, function extremelyvery well in in: •

strengthening board leadership, leadership; •

fostering cohesive decision making at the board level, level; •

solidifying director collegiality, collegiality; •

improving problem solvingsolving; and •

enhancing strategy formulation and implementation. Risk Oversight Our board of directors has an active role in overseeing the management of risks applicable to us and our operations. We face a number of risks, including strategic risks, economic risks, competitive risks, financing risks, environmental and regulatory risks, and other risks, such as the impact of competition.information security risks. Our board of directors manages our risks through its ongoing oversight and review of all timberlandour acquisitions and dispositions, our joint ventures and our debt and equity financing

transactions andalong with its supervision of our executive officers. The Audit Committee, Each of the Compensation Committee, the Nominating Committee and the Finance Committee eachBoard’s committees monitor and oversee the management of risks relevant to those committees. Audit Committee. The Audit Committee oversees risks related to our system of internal controls, including information security risks, and is responsible for overseeing our annual enterprise risk assessment. Compensation Committee. The Compensation Committee oversee risks associated with our compensation program, including any risks related to the structure of our incentive compensation program, as well as risks related to human capital management. Nominating Committee. The Nominating Committee oversees environment, social and governance risks.

Finance Committee. The Finance Committee oversees risks related to acquisitions and dispositions along with financing-related risks. Our board of directors stays informed of each committee’s risk oversight by way of regular reports from the Chair of each committee regarding that committee’s actions. Our board of directors has retained responsibility for oversight of strategic risks and all other risks not otherwise delegated to one of its committees but may establish additional committees in the future to address specific areas of risk as it deems appropriate and in the best interest of our stockholders. We believe that our risk oversight structure is also supported by our current board leadership structure, with the Chairman of the Board working together with each of our independent Audit Committee and our other standing committees to monitor risks. Meetings of Independent DirectorsBoard and Committees Self-Evaluation

To promote the independence of ourOur board of directors and appropriate oversight of management, our independent directors meet in executive sessions at which only independent directors are present. During these sessions, Mr. Potts, independent director and Chairman ofeach standing board committee conducts a self-evaluation annually to evaluate the Board, presides. These meetings are held in conjunction with the regularly scheduled quarterly meetings of our board of directors, but may be called at any time by our independent directors. In 2015, our independent directors met five times in executive session without management present following meetings of our board of directors. Our board of directors may modify this structure if it determines that a different structure is in the best interest of our stockholders.

Director Independence

Six of the eight members of our board of directors, and all of the members of the Audit Committee, the Compensation Committee and the Nominating Committee are “independent” as defined by the New York Stock Exchange (“NYSE”), and a majority of the members of the Finance Committee meet the NYSE’s definition of independence. The NYSE listing standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, our board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder, or officer of an organization that has a relationship with us). Our board of directors has determined that each of Alan D. Gold, Paul S. Fisher, Donald S. Moss, Willis J. Potts, Jr., Douglas D. Rubenstein, and Henry G. Zigtema qualifies as an independent director under the listing standards of the NYSE. Two of our current directors, Jerry Barag and John F. Rasor, are our executive officers, and we do not consider them to be independent directors.

In addition to the independence requirements discussed above, members of the Audit Committee also must satisfy additional independence requirements established by the SEC and the NYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than their directors’ compensation and they may not be affiliated with us or any of our subsidiaries. Our board has determined that all the members of the Audit Committee satisfy the relevant SEC and NYSE independence requirements.

Further, in affirmatively determining the independence of any director who will serve on the Compensation Committee, our board also considers all factors specifically relevant to determining whether a director has a relationship to us that is material to that director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee, including (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by us to such director and (2) whether the director is affiliated with us, our subsidiaries or our affiliates.

Board Committees

Our board of directors has established the following standing committees: the Audit Committee, the Nominating Committee, the Compensation Committee and the Finance Committee. Information regarding each of the committees is discussed below.

Audit Committee

Our board of directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee’s primary function is to assist our board of directors in fulfilling its responsibilities by selecting the independent auditors to audit our financial statements; reviewing with the independent auditors the plans and results of the audit engagement, approving the audit and overseeing our independent auditors; reviewing the financial information to be provided to our stockholders and others; reviewing the independence of the independent public accountants; considering the adequacy of fees; and reviewing the system of internal control over financial reporting which our management has established and our audit and financial reporting process. The Audit Committee also is responsible for overseeing our compliance with applicable laws and regulations and for establishing procedures for the ethical conduct of our business.

The Audit Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Audit Committee Charter adopted by our board of directors. The Audit Committee Charter is available on our web site at www.catchmark.com.

Our Audit Committee currently consists of Donald S. Moss, Willis J. Potts, Jr., Douglas D. Rubenstein, and Henry G. Zigtema. All of the members of the Audit Committee are “independent” as defined under the rules of the NYSE. Henry G. Zigtema is designated as the Audit Committee financial expert and is the Chairman of the Audit Committee. During 2015, the Audit Committee met five times.

Nominating and Corporate Governance Committee

The primary functions of the Nominating Committee are identifying individuals qualified to serve on our board of directors; overseeing, developing and recommending to our board of directors a set of corporate governance policies and principles and periodically re‑evaluating such policies and guidelines for the purpose of suggesting amendments to them if appropriate; determining the composition of our board of directors; and overseeing an annual evaluationeffectiveness of our board of directors and each of its standing committees, focusing on the contribution of our board of directors as a whole and areas in which our board of directors or management believes a better contribution is possible. Pursuant to our Amended and Restated Corporate Governance Guidelines (the “Corporate Governance Guidelines”) and the charters of each of the standing board committees, the Nominating Committee oversees the self-evaluation process. The results of the self-evaluations are discussed by the members of our board of directors, and our management.

The Nominating Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Nominating Committee and Corporate Governance Charter adopted by our board of directors. The Nominating and Corporate Governance Committee Charter is available on our website at www.catchmark.com.

The Nominating Committee currently consists of Paul S. Fisher, Alan D. Gold, Douglas D. Rubenstein and Henry G. Zigtema. All of the members of the Nominating Committee are “independent” under the listing standards of the NYSE. Mr. Rubenstein is the Chairman of the Nominating Committee. During 2015, the Nominating Committee met four times.Board and chairpersons of each committee coordinate any necessary follow-up actions.

Corporate Governance Guidelines Board Membership Criteria

The Nominating Committee annually reviews with our board of directors the appropriate experience, skills and characteristics required of board members in the context of the then‑current membership of our board of directors. This assessment includes, in the context of the perceived needs of our board of directors at that time, issues of knowledge, experience, judgment and skills such as an understanding of the real estate industry, the timber industry or brokerage industry or accounting or financial management expertise. Therefore, our board of directors and the Nominating Committee have sought a diverse board of directors whose members collectively possess these skills and experiences. Although our board of directors does not have a formal written policy regarding the consideration of diversity in identifying director nominees, diversity will continue to be a factor that is considered in identifying and recruiting new directors. Other considerations include the candidate’s independence from conflict with us and the ability of the candidate to attend board meetings regularly and to devote an appropriate amount of effort in preparation for those meetings. It also is expected that independent directors nominated by our board of directors shall be individuals who possess a reputation and hold (or have held) positions or affiliations befitting a director of a large publicly registered company and are (or have been) actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. As detailed in the director biographies above, our board of directors and the Nominating Committee believe that the slate of directors recommended for election at the annual meeting possess these diverse skills and experiences.

Selection of Directors

Our board of directors is responsible for selecting its own nominees and recommending them for election by the stockholders. Our board of directors delegates the screening process necessary to identify qualified candidates to the Nominating Committee. The Nominating Committee annually reviews director suitability and the continuing composition of our board of directors; it then recommends director nominees who are voted on by our full board of directors. All director nominees then stand for election by our stockholders annually.

In recommending director nominees to our board of directors, the Nominating Committee solicits candidate recommendations from its own members and our management. The Nominating Committee may engage the services of a search firm to assist in identifying potential director nominees. The Nominating Committee also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In evaluating the persons recommended as potential directors, the Nominating Committee will consider each candidate without regard to the source of the recommendation and take into account those factors that the Nominating Committee determines are relevant. Stockholders may directly nominate potential directors (withoutUpon the recommendation of the Nominating Committee) by satisfyingCommittee, our board of directors adopted the procedural requirements for such nomination as provided in Article II, Section 11Corporate Governance Guidelines, which establish a common set of our bylaws. Any stockholder may request a copy of our bylaws free of charge by contacting our Secretary at our headquarters c/o CatchMark Timber Trust, Inc., 5 Concourse Parkway, Suite 2325, Atlanta, Georgia 30328; by email at info@catchmark.com; by telephone at 855-858-9794 (Atlanta area: 404-445-8480); or by facsimile at 855-865-8223.

Compensation Committee

The primary function of the Compensation Committee isexpectations to assist our board of directors in fulfillingperforming its responsibilities with respect to the compensationresponsibilities. The Corporate Governance Guidelines, a copy of our Chief Executive Officer and our other executive officers and the administration of our compensation plans, programs and policies. For additional information about the Compensation Committee’s processes and the role of executive officers and compensation consultants in determining compensation, see “Compensation Discussion and Analysis” below.

The Compensation Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Compensation Committee Charter adopted by our board of directors. The Compensation Committee Charterwhich is available on our website at https://catchmark.investorroom.com/governance-policies, address a number of topics, including, among other things:

www.catchmark.com•

board membership criteria, including relevant skill and experience as well as gender, racial and ethnic diversity; •

selection of directors; •

size of the board; •

independence requirements; •

our director resignation policy if a director does not receive a majority of the votes cast; •

term limits; •

director compensation; •

director responsibilities and continuing education requirements; •

communications with stockholders; •

succession planning; •

self-evaluations; and •

director access to management and independent advisors. Code of Business Conduct and Ethics All of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, must act ethically at all times and in accordance with the policies comprising our code of business conduct and ethics set forth in the Amended and Restated Code of Business Conduct and Ethics (the “Code of Ethics”). The Code of Ethics is published and can be viewed on our website at https://catchmark.investorroom.com/governance-policies. Within the time period required by the SEC and the NYSE, we will post on our website any amendment to or waiver of the Code of Ethics. Related Person Transactions Policy Our board of directors recognizes that transactions and relationships between the Company and persons related to the Company can present a heightened risk of actual or potential conflicts of interest and may create the appearance that Company decisions are based on considerations other than those in the best interest of the Company and its stockholders. As a result, the board of directors has adopted a related person transactions policy which provides that all related person transactions are subject to Audit Committee approval or ratification. A “related person transaction” is any transaction or series of transactions in which: •

the Company or any of its subsidiaries is a participant; •

any “related person” (an executive officer, director, beneficial owner of more than 5% of the Company’s common stock, or immediate family member or business affiliate of any of the foregoing) has or will have a direct or indirect material interest; and •

the aggregate amount involved since the beginning of the Company’s last completed

fiscal year exceeds or may reasonably be expected to exceed $120,000. At least annually, each director and executive officer completes a detailed questionnaire that discloses any related person transactions. We also review the Company’s financial records to identify any related person transactions. In determining whether to approve or ratify a related person transaction, the Audit Committee considers all relevant facts and circumstances, including: •

the benefits to the Company; •

the potential effects on a director’s independence; •

the availability of other sources for the product or service; •

the terms of the transaction; and •

the terms related to unrelated parties generally. The CompensationAudit Committee currently consists of Alan D. Gold, Paul S. Fisher, Donald S. Moss and Willis J. Potts, Jr. Allmay approve a related person transaction that it determines to be not inconsistent with the best interests of the membersCompany and its stockholders. Independent Director Compensation Program Our independent directors are compensated pursuant to our Amended and Restated Independent Director Compensation Plan, the terms of which are described below. Cash Compensation. Each of our independent directors (other than a member of the Audit Committee) receives an annual cash retainer of $50,000, and each of our independent directors who is a member of the Audit Committee receives an annual cash retainer of $56,000. In addition, the chair of the Audit Committee receives a supplemental cash retainer of $12,500, and the chairs of the Compensation Committee, are “independent” under the listing standardsNominating Committee and Finance Committee receive a supplemental cash retainer of the NYSE and under the rules and regulations of the SEC, discussed in further detail under “-Director Independence” above. Mr. Moss is the$10,000. The non-executive Chairman of the Compensation Committee. During 2015,Board receives a supplemental cash retainer of $50,000. A director may choose to receive his or her cash retainers in shares of our common stock. Equity Compensation. We also make an annual equity grant to our independent directors. In 2021, we made this grant on June 25, 2021, the first business day immediately following our 2021 annual meeting, to each of our directors that was re-elected at the meeting. The equity grant had a value of $70,000 on the grant date and directors had the right to elect to receive their equity grant in the form of shares of our common stock or LTIP units in our operating partnership. For more information regarding our LTIP units, see Note 8 — Noncontrolling Interest to our consolidated financial statements included in our annual report on Form 10-K filed with the SEC on March 3, 2022. The number of shares or LTIP units granted to each independent director was determined by dividing $70,000 by the fair market value per share of our common stock or per LTIP unit, as applicable, on the grant date.

2021 Director Compensation Committee met six times. FinanceThe following table provides information about the compensation earned by our independent directors during 2021:

| | Name | | | Fees Earned or

Paid in Cash(1)

($) | | | Stock Awards(2)(3)

($) | | | Total

($) | | | | Tim E. Bentsen | | | | | 68,500 | | | | | | 69,998 | | | | | | 138,498 | | | | | James M. DeCosmo | | | | | 60,000 | | | | | | 69,998 | | | | | | 129,998 | | | | | Paul S. Fisher | | | | | 60,000 | | | | | | 69,998 | | | | | | 129,998 | | | | | Mary E. McBride | | | | | 66,000 | | | | | | 69,998 | | | | | | 135,998 | | | | | Douglas D. Rubenstein | | | | | 106,000 | | | | | | 69,998 | | | | | | 175,998 | | |

(1)

Includes base retainer and Investment Committee The primary functionsupplemental retainer, which are payable quarterly in advance of the Finance Committee isrelevant quarter.

(2)